There are many factors to take into account when you’re thinking about buying or selling a home. One of the biggest is the prevailing average interest rate on mortgage loans.

If you’re buying, a higher rate can affect how much home you can afford in the short term. If you’re selling and average rates are higher than the one on your current mortgage, chances are you’re not in a hurry to give up your lower rate unless a move is absolutely necessary for you and your family.

Average mortgage rates are constantly changing. For the layperson, it can be difficult to keep track of them or make sense of volatile market conditions. We’ll try to simplify it a bit for you – and hopefully make you feel better about your homebuying plans – by pointing out these three things:

1. Inflation has driven rates higher. Elevated inflation has been a fact of life for almost two years now, and it has made everything more expensive, from food to mortgages. In an attempt to rein in inflation, the Federal Reserve has raised its own lending rate, which is the amount banks pay to borrow money from each other overnight. That rate increase has also been reflected in other borrowing costs, such as loans for cars and homes. Fortunately, the Fed’s initiatives have been successful in taming inflation, which leads some experts to believe that interest rates will come back down soon. But the job market in particular remains strong, so the markets are waiting for more proof that inflation has reduced before rates will start dropping.

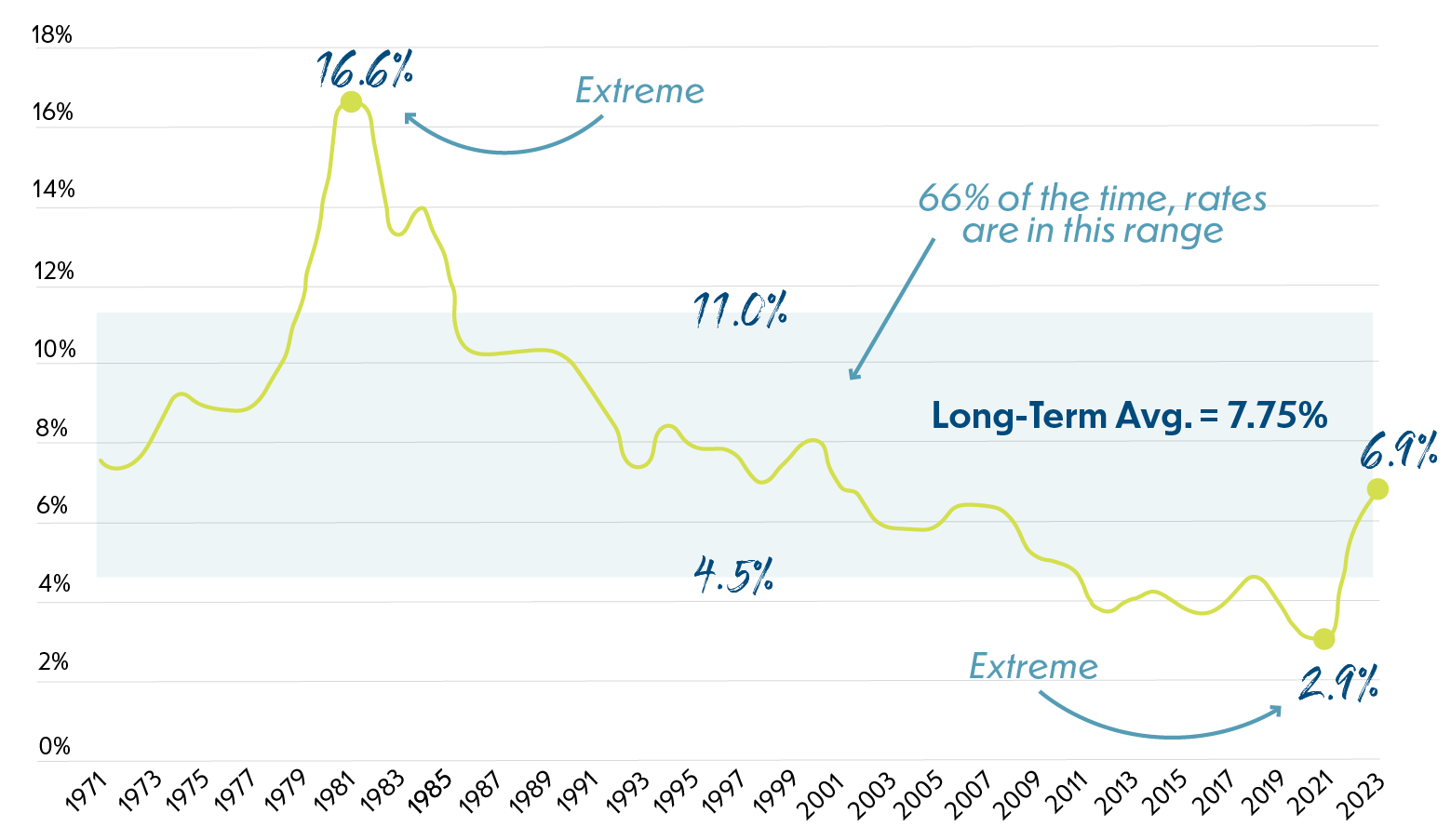

2. Mortgage rates are still within the average range. Yes, they’re higher than in recent years, but as you’ll see in this graph gleaned from mortgage data since 1971, today’s interest rates are smack dab in the middle of where they usually are:

3. It’s abnormal for rates to be under 4.5% or over 11%. You’ve probably heard horror stories about how high interest rates on home loans were in the early ’80s. The glory days of mortgage rates dipping into the high 2s happened pretty recently, so those are likely still fresh in your memory. In truth, neither situation is the norm, and while they’re not ideal compared to 2021, today’s rates are essentially in the neighborhood where they’ve typically been for the better part of 50 years.

It’s also important to remember that there are still ways you can get a great mortgage rate, even when average rates are higher. So before you get super discouraged about today’s rates, contact your local Homeowners Licensed Mortgage Professional and turn that frown upside down!