Great news! Fannie Mae has announced a change to their Automated Underwriting System that will allow more borrowers to qualify! Beginning 9/18/2021, Fannie Mae will allow credit scores to be averaged for the purpose of qualifying. This applies to loans with more than one borrower and does not impact pricing, mortgage insurance requirements, or RefiNow loans.

HOW IT WORKS

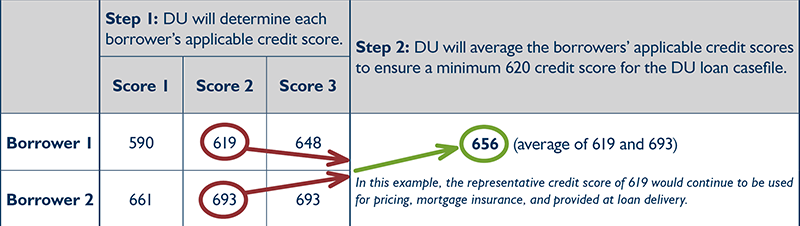

First, DU will determine each borrower’s applicable credit score (middle of the three scores received, or the lower of the two when only two scores received).

Second, DU will average the applicable credit scores for all of the borrowers on the loan casefile to determine if the minimum 620 credit score requirement is met.

Contact your local Homeowners Licensed Mortgage Professional with any questions or to learn more. As always, we’re here to help!