If you love the house, make them love the offer! The National Association of Realtors® just reported that home sales in August surged to their highest level in 14 years – since December 2006!* In a seller’s market it is not uncommon for a property to receive multiple purchase offers, putting it in the seller’s hand to decide the best option. When considering a home purchase, consider all aspects of your offer, which is not always lowest price.

In looking at price vs. payment, it’s important to note that the most common 30 year fixed mortgage allows you to amortize an increased price over 360 monthly payments. This means, for example, that even an extra $10,000 in the offer could equate to only $50 more per month in the payment. Additionally, the price you pay now may positively impact your home’s worth in the future, as appraisers use recent property sales in your area to help establish price for new home sales.

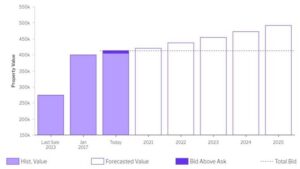

We have a tool to help buyers understand how to evaluate a bid-over-ask in a bidding war, based on forecasted appreciation specific to where the property is located and potential time to recoup. If you’d like us to show you this free report, reach out to your local HFG Licensed Mortgage Professional.

Understanding the power of a prequalification can be the difference between moving in or missing out. A seller is likely to give preference to buyers who pose the least amount of risk, and a prequalification will indicate that you are serious about the purchase, as well as that when it’s time to close, you will have the money. We’re here to help you close quickly, without any hassle, and with a higher probability of an accepted offer.

*http://www.mortgagenewsdaily.com/09222020_existing_home_sales.asp