First-Time Homebuyers

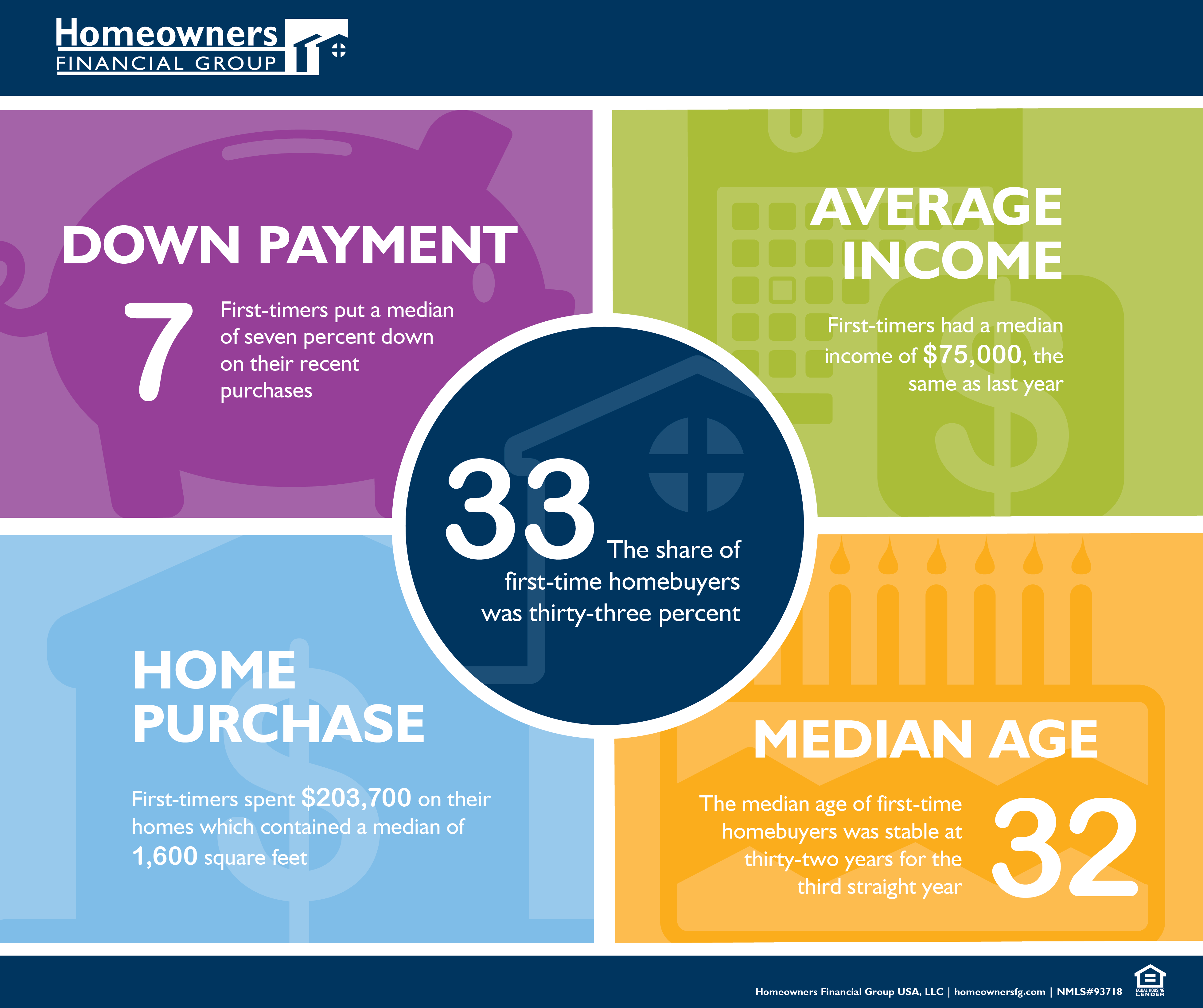

Buying your first home may seem like a distant dream, but it may be prime time for first-time buyers who represented 33% of all home purchases, according to an annual survey from the National Association of Realtors®.

This 2018 Profile of Home Buyers and Sellers also showed that for first-time homebuyers in particular, the median age remained 32 years old for the third straight year with a median income of $75,000. Looking at property-related statistics, the average spent on a home was $203,700 with an average size of 1,600 square feet.

Interestingly, this report reported the highest (7%) down payment of first-time buyers since 1997, citing that saving for a down payment was the largest hurdle and that student debt balances are an increasing concern for this group.

Did you know that Homeowners Financial Group has multiple mortgage products designed for first-time buyers, which include features like minimal down payment and flexible guidelines for student loan debt? Partnering with state agencies, we also have access to assistance products to help with closing costs, and additional options available for teachers, military and first responders.

Don’t allow perceived hurdles to get in your way. Take the first step and reach out to our experienced Licensed Mortgage Professionals so they can help you toward the finish line of homeownership.

Source: National Association of Realtors (NAR) Annual Survey (July 2017 – June 2018) http://www.mortgagenewsdaily.com/10292018_nar_buyer_survey.asp