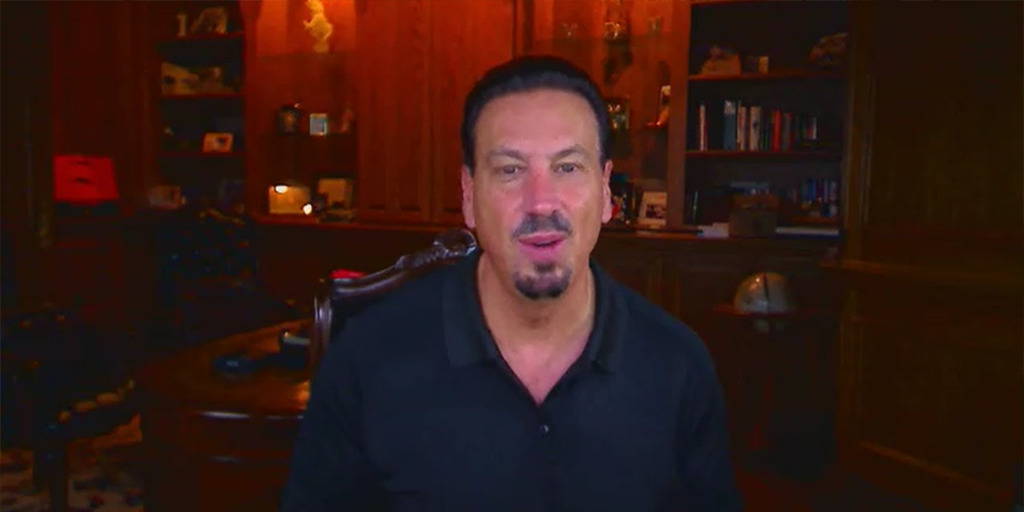

Barry Habib, MBS Highway Founder and CEO, recently spoke about our long-standing partnership and how we leverage their cutting-edge digital platform to assist our clients in making better-informed decisions.

“It always seems like Homeowners Financial likes to be on the cutting edge of using technology to help their customers have a better experience,” he said.

One of the highly used reports is the Cost of Waiting Analysis which details the potential rise in total costs and missed opportunities for appreciation by delaying a home purchase. Matched with potential loan scenarios, it is a clear picture for anyone thinking about purchasing a property. The Annual Review analysis arms current homeowners with financial forecasts based on options to refinance, the potential elimination of mortgage insurance, or even to sell the current property and ‘move up’ to their dream home.

Online Lenders have an ability to provide lightning fast rate quotes but we believe our experienced professionals can provide much more to our client’s real estate partners than just a single figure. Barry went on to explain the value of our Licensed Mortgage Professionals equipped with these tools, “They really help the borrower see the opportunity, and help the real estate agent articulate the financial opportunity that exists in homeownership.”

Check out a special message from Barry Habib below:

We enjoy being a true advisor for all your mortgage needs and the partnership with MBS Highway takes it to another level. If you are looking to purchase or refinance we would enjoy the opportunity to present you with personalized information to make an informed decision. Please contact a Licensed Mortgage Professional at a Homeowners Financial Group location near you.