There are many ways to “work on your fitness” and many kinds of fitness to work on. If you see yourself as a bodybuilder, throwing some weights around in the gym is a necessity. If you see yourself as a homeowner, dialing in your dollars and cents will serve you well.

At Homeowners Financial Group, we’re all about making the dream of owning your own home as easy as possible. Our job is to do that during the actual mortgage process, but you play a role too, especially in advance of applying for a home loan.

The key is to control what you can control. Here are 4 ways you can do that with regard to your finances:

1. Live within your means.

Why should you avoid buying unnecessary things and only buy what you need when you’re planning on buying a home?

- Affordability. Owning a home is a big financial commitment, but it shouldn’t bring stress into your life. Avoiding taking on more debt than you can handle can help ensure that you can comfortably make your mortgage payments.

- Saving for a down payment. The larger your down payment, the less you’ll need to borrow, which can result in lower monthly payments and a more affordable mortgage.

- Qualifying for a mortgage. Maintaining a good debt-to-income ratio and protecting your credit score can increase your chances of getting approved for a home loan.

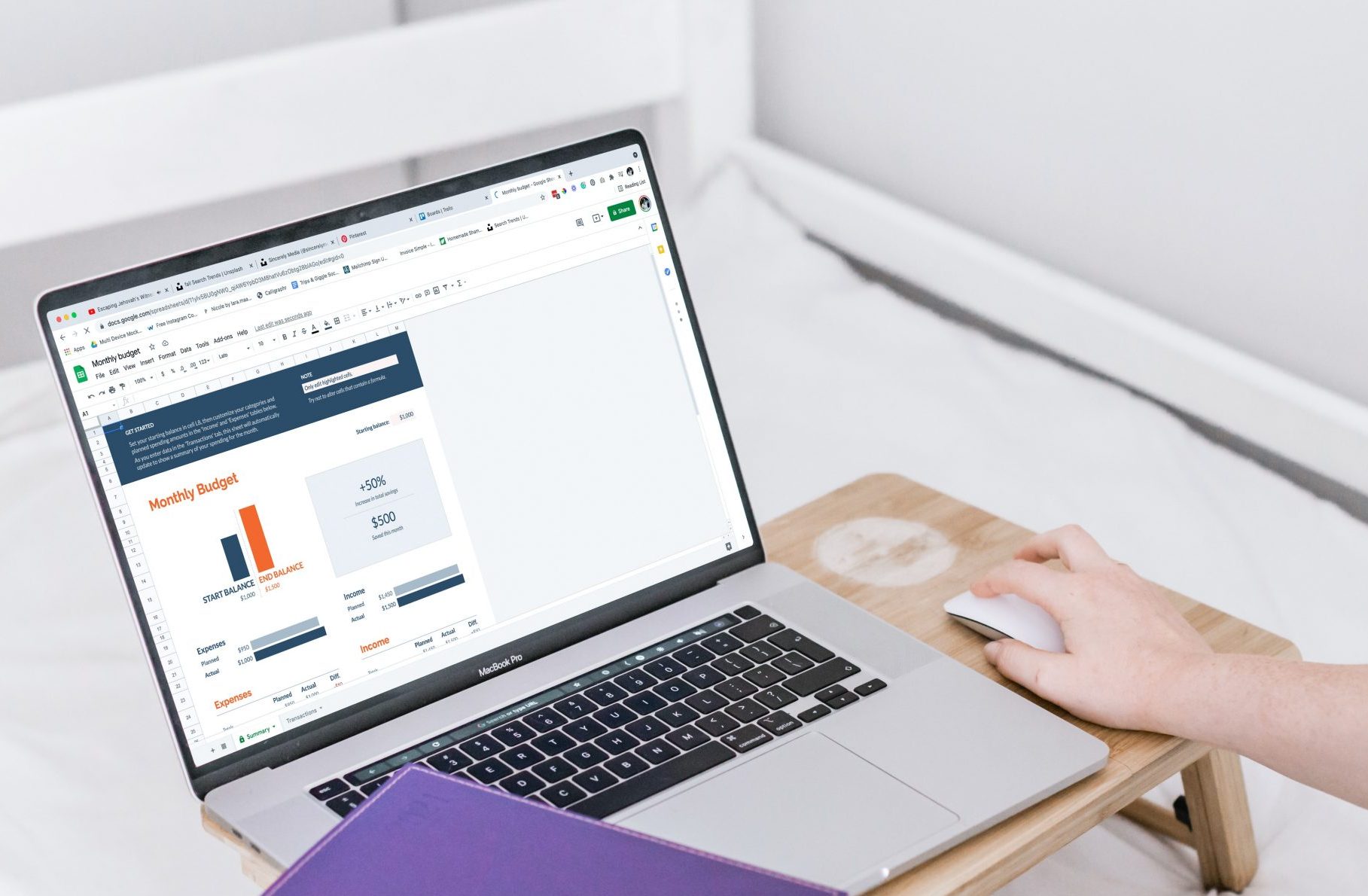

2. Know where your money goes.

Why should you make sure that your expenses don’t exceed your income?

- Creating a realistic budget. With a clear picture of how much money you have coming in and going out each month, you’ll have a better idea of how your home purchase will fit into everything.

- Managing debt. If you have debt, tracking your expenses can help you prioritize your payments and make progress toward paying off your balances.

- Preparing for homeownership costs. Owning a home comes with additional costs, such as property taxes, insurance, and maintenance. You should know how much money you’ll need to set aside each month for these costs and be financially prepared for homeownership.

3. Work to be debt free.

Why is it important to have as little debt as possible?

- Lowering your mortgage payments. When you have fewer debts, you have fewer monthly payments to make. This means that you’ll have more money available to put toward a mortgage down payment, which may result in a more affordable monthly payment going forward.

- Enjoying financial flexibility. Being debt-free or having low levels of debt can make you less reliant on credit cards or other high-interest loans when unexpected expenses arise.

- Experiencing less stress. When you don’t have to make multiple monthly payments or juggle different debts, you can truly enjoy your home purchase without worrying about your finances.

4. Save for unforeseen circumstances.

Why should you expect the unexpected and have money to be able to deal with it?

- Making home repairs. Being a homeowner means you’ll be fixing stuff, even if you buy a newer home. Having an emergency fund can help you cover these costs without having to dip into your regular budget.

- Keeping up with your payments. If you lose your job or experience a decrease in income, having an emergency fund can help you continue making your mortgage payment and other monthly obligations until you find a new job or get back on your feet.

- Loving where you live. When you’re not worrying about unexpected expenses derailing your budget or causing financial stress, you can focus on enjoying your home and your life.

Remember, it’s always a good idea to have a financial advisor or accountant in your corner who can give you more in-depth advice about these things. But we’re happy to help however we can, and we hope these tips are useful for you.

Of course, our specialty is home loans, so contact your local Homeowners Licensed Mortgage Professional today to go over the mortgage options that are available to you in your quest to purchase a property!

Homeowners Financial Group does not provide financial planning, accounting, or credit repair services. Please consult professionals who specialize in those specific areas for advice about your unique circumstances.